Spend for Your Future: Comprehending the EB-5 Visa and Visa Process

The EB-5 Visa program provides an engaging avenue for international capitalists looking for U.S. long-term residency with strategic investments that boost work development - EB-5 Visa by Investment. With a minimal investment threshold of $800,000, this program not only promotes the financier's immigration process however also contributes to the wider economic landscape. However, steering via the details of qualification demands, investment options, and the application timeline can be complicated. Recognizing these elements is important for making educated decisions that might greatly influence your future, yet many prospective candidates stay unaware of the nuances entailed

Overview of the EB-5 Visa

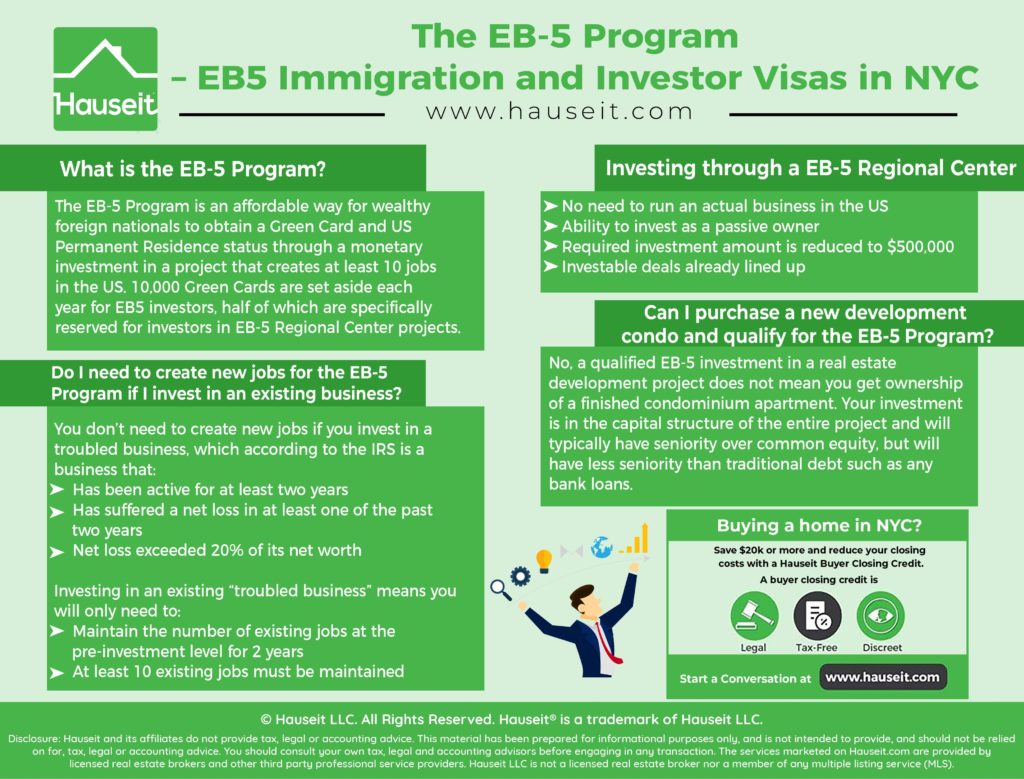

The EB-5 Visa program uses an unique pathway for international investors seeking long-term residency in the USA. Developed under the Immigration Act of 1990, this program aims to promote the united state economic climate via capital expense and job production. Capitalists who qualify can get a visa for themselves and their prompt member of the family by investing a minimum of $1 million in a new business or $500,000 in a targeted work location, which is defined as a backwoods or one with high joblessness

The EB-5 Visa not just helps with access to long-term residency however additionally allows capitalists to take part in a vivid industry. By developing or maintaining at least 10 permanent work for united state employees, the capitalist can accomplish one of the crucial needs of the program (EB-5 Visa by Investment). The financial investment can be made directly in an organization or through an assigned Regional Center, which takes care of the investment process and task development in support of the financier

Qualification Needs

To get the EB-5 Visa, investors need to fulfill specific credentials and adhere to recommended financial investment quantities. These requirements are created to assure that candidates add significantly to the U. EB-5 Investment Amount.S. economic climate while also enhancing work creation. Recognizing these eligibility standards is crucial for prospective investors seeking permanent residency with the EB-5 program

Investor Credentials

Capitalist certifications for the EB-5 visa program are crucial in determining qualification for participation in this pathway to long-term residency in the United States. To qualify, a capitalist should be a foreign national that agrees to purchase a new commercial enterprise that creates tasks for U.S. workers.

The capitalist needs to show that they have the requisite funding, which can be sourced from lawful means. Furthermore, the financier's funds should be at threat, indicating they can not be ensured a return on their investment. This standard highlights the requirement for commitment to the enterprise.

In addition, the financier must be proactively included in the management of business or have a policy-making duty, guaranteeing that they are adding to the success of the business. Importantly, the financier needs to also satisfy the minimum age demand of 21 years.

Finally, it is essential for capitalists to confirm that their financial investment aligns with the EB-5 program's financial and geographical criteria, especially if spending in a targeted work area (TEA), which might offer certain advantages. Comprehending these qualifications is vital to maneuvering the EB-5 visa process efficiently.

Investment Amounts Required

Qualification for the EB-5 visa program pivots significantly on the financial investment amounts required, which are readied to assure that international financiers contribute meaningfully to the U.S. economic climate. As of the newest standards, the minimum investment needed is $1 million. This quantity is minimized to $800,000 if the investment is made in a targeted employment area (TEA), which is generally a rural area or one with high unemployment rates.

These investment amounts are vital as they are developed to promote job creation and financial development within the United States. Each EB-5 financier is needed to show that their investment will certainly produce or maintain at the very least 10 permanent jobs for U.S. workers within 2 years of the capitalist's admission to the nation.

In addition, it is important for investors to conduct thorough due persistance when choosing a job, as the potential for task production and the total stability of the financial investment directly affect the success of their application. Comprehending these monetary demands is a fundamental action in guiding with the EB-5 visa process and protecting a pathway to permanent residency in the united state

Investment Options

When considering financial investment choices for the EB-5 program, it is necessary to understand the numerous sorts of financial investments available. Investors have to likewise evaluate the associated threats, making sure a knowledgeable choice that lines up with their financial objectives. This discussion will certainly explore both the types of financial investments and effective threat assessment approaches.

Kinds of Investments

The landscape of EB-5 financial investments provides a selection of choices tailored to satisfy the varied goals of possible investors. At its core, the EB-5 program enables people to buy brand-new commercial business that will certainly preserve or produce at the very least 10 permanent jobs for certifying united state workers.

Capitalists can select straight investments in their very own service ventures. This course needs a more hands-on technique and straight involvement in managing the business, permitting for higher control over the investment.

Furthermore, investors can think about traditional financial investments in approved jobs that fulfill the EB-5 criteria. These can vary from producing facilities to friendliness advancements, each with potential returns and special offerings.

Inevitably, the choice of investment need to align with the capitalist's monetary goals, threat Source tolerance, and level of desired involvement, enabling them to accomplish visa requirements while going after growth chances in the united state economy.

Risk Evaluation Strategies

Effective danger examination approaches are vital for EB-5 capitalists looking for to browse the intricacies of financial investment options. Examining the stability of an investment calls for an extensive understanding of both the financial landscape and the specific task in concern. Capitalists need to start by performing due persistance on the Regional Facility or task enroller, inspecting their track document, economic security, and conformity with EB-5 policies.

It is essential to evaluate the market conditions pertinent to the investment. Assessing the local economy, industry trends, and competition can offer insights right into potential dangers and returns. Investors ought to also consider the project's work development capacity, as this is a crucial need for EB-5 visa eligibility.

Diversification can reduce risks associated with specific financial investments. By spreading capital throughout several projects or fields, capitalists can decrease the impact of a solitary financial investment's underperformance. Involving with skilled lawful and monetary experts can aid navigate complicated regulations and determine red flags that may not be right away noticeable.

The Regional Center Program

Developed to stimulate economic growth and task production in targeted areas, the Regional Center Program is a crucial part of the EB-5 visa effort. Developed by the United State Citizenship and Immigration Services (USCIS), this program enables financiers to merge their funding into designated Regional Centers, which are entities authorized to assist in investment tasks that meet particular economic standards.

The primary goal of the program is to produce or protect at the very least 10 permanent work for U.S. workers per investor. Regional Centers usually concentrate on financially troubled locations, therefore boosting neighborhood economic climates while supplying a pathway to long-term residency for foreign financiers. By investing a minimum of $800,000 in a targeted employment area (TEA) or $1,050,000 in a non-TEA, investors can add to varied tasks, consisting of property growths, framework renovations, and other company ventures.

In addition, financial investments via Regional Centers usually include a reduced concern of straight work production requirements, as the task production can be indirect or generated. This adaptability makes the Regional Center Program an appealing choice for many international nationals looking for to obtain a united state visa through financial investment.

Application Process

Steering with the application process for an EB-5 visa entails a number of key actions that possible investors should comply with to guarantee compliance with U.S. migration guidelines. The first step is to recognize a proper EB-5 job, ideally through an assigned local facility, guaranteeing it fulfills the investment and task creation needs.

When a job is selected, capitalists should prepare the needed paperwork, that includes evidence of the source of funds, a thorough service plan, and legal arrangements connected to the investment. This stage is critical as it establishes the legitimacy of the investment and its positioning with EB-5 requirements.

Following paper preparation, investors should complete Kind I-526, the Immigrant Petition by Alien Financier. This form requires extensive information about the financier and the financial investment's qualifications. Once submitted, the petition undertakes review by united state Citizenship and Immigration Solutions (USCIS)

Upon authorization of the I-526 application, investors can proceed to use for their conditional visa. This phase involves submitting additional kinds and participating in an interview, where the investor needs to demonstrate their intent to meet the financial investment requirements and create the requisite jobs. Each of these actions is necessary for an effective EB-5 visa.

Timeline and Processing

Maneuvering the timeline and handling for the EB-5 visa can be complex, as numerous factors influence the duration of each stage. Typically, the process begins with the submission of Form I-526, the Immigrant Request by Alien Financier. This preliminary request can take anywhere from six months to over two years for approval, depending on the service facility's work and the specifics of the financial investment project.

When the I-526 request is authorized, financiers might obtain conditional permanent residency through Kind I-485, or if outside the united state, they may undergo consular processing. This action can take an added 6 months to a year. Upon obtaining conditional residency, financiers need to satisfy the investment and job creation needs within the two-year duration.

Benefits of the EB-5 Visa

The EB-5 visa offers a path to irreversible residency for foreign investors, giving them with significant benefits beyond simply migration (EB-5 Investment Amount). Among the primary advantages is the chance for capitalists and their instant relative to get united state environment-friendly cards, giving them the right to live, work, and research study in the United States without limitations

On top of that, the EB-5 program promotes task production and financial development in the U.S., as it requires investors to develop or preserve at the very least 10 full time tasks for American workers. This not only benefits the economy but also enhances the investor's area standing.

The EB-5 visa is distinct in that it does not require a specific service history or prior experience in the United state market, enabling a wider array of individuals to take part. Investors can additionally appreciate a reasonably expedited path to citizenship after maintaining their irreversible residency for five years.

Frequently Asked Inquiries

Can I Include My Household Members in My EB-5 Application?

Yes, you can include prompt household members-- such as your spouse and single children under 21-- in your EB-5 application. This incorporation allows them to gain from the immigrant investor program alongside you.

What Happens if My Financial Investment Fails?

If your investment falls short, you may not fulfill the EB-5 program needs, causing the potential loss of your visa qualification. It's important to conduct thorough due diligence before spending to mitigate dangers properly.

Exist Age Restrictions for EB-5 Investors?

There are no certain age restrictions for EB-5 financiers. Candidates must demonstrate that they fulfill the investment requirements and conform with regulations, regardless of their age, making sure eligibility for the visa process.

Can I Make An Application For Citizenship After Getting the Visa?

Yes, after obtaining a visa, you may request U.S. citizenship with naturalization. Normally, you have to maintain irreversible resident status for at the very least 5 years, showing excellent moral personality and fulfilling other needs.

Is There a Limitation on the Variety Of EB-5 Visas Issued Each Year?

Yes, there is an annual restriction on EB-5 visas. Presently, the program assigns 10,000 visas each financial year, with added arrangements for relative of investors, which can influence total availability and handling times.

The EB-5 Visa program presents a compelling avenue for international investors seeking U.S. irreversible residency through tactical investments that boost work production. To certify for the EB-5 Visa, capitalists have to satisfy particular qualifications and adhere to prescribed investment quantities - EB-5 Investment Amount. It is necessary for investors to confirm that their financial investment aligns with the EB-5 program's geographical and economic standards, specifically if investing in a targeted employment area (TEA), which may supply specific advantages. Qualification for the EB-5 visa program hinges dramatically on the investment quantities called for, which are set to guarantee that international financiers contribute meaningfully to the U.S. economy. Complying with document prep work, capitalists need to finish Form I-526, the Immigrant Request by Alien Capitalist